8 of the Most Expensive Cities in the US to Buy a Home

Buying a home is a major financial decision, and for some, a once-in-a-lifetime investment. The cost of buying a home varies widely depending on where you live, making it important to research the cost of living in any city before deciding to settle down.

The most expensive cities in the US to buy a home tend to be in major metropolitan areas, with prices that often exceed the national average. However, buying a house in Houston is considered one of the least expensive metropolitan areas to buy a home.

In this article, we’ll explore eight of the most expensive cities in the US to buy a home and what it will cost you. We’ll look at the median price of a home in each city and compare it to the national median, so you can get a better idea of what the cost of buying a home could be.

1. San Francisco, CA

It’s no surprise that the city with the highest cost of living in the US also has the highest price to buy a home. The median price to buy a home in San Francisco is $1,418,093.

In San Francisco, California, you can expect to pay a premium for everything from food, housing, and healthcare to transportation and education. While a home in this city may be a little out of reach for some buyers, there are many other options for those budgeting for a home.

If you’re looking to buy a home in San Francisco, you’ll likely need to budget for a sizable down payment too. The average down payment is about $150,000, and the city has some of the strictest lending requirements in the country.

2. San Jose, CA

Home to Silicon Valley, the median price to buy a home in San Jose is $1,098,000. Silicon Valley is one of the most expensive places to live in the US, and buying a home is no exception.

The city has a thriving technology sector that fuels its economy, but the high cost of living in the area makes it unaffordable for many. In addition to high housing costs, the cost of living in San Jose is higher than average in other areas too.

The city’s high cost of living is due to the high salaries of many residents as well as the high cost of goods and services. If you’re planning to buy a home in San Jose, expect to pay about 9% in real estate taxes annually on top of your mortgage payments.

3. Los Angeles, CA

The median price to buy a home in Los Angeles is $719,000. Los Angeles is one of the most popular cities in the US, and many people come to the city to find opportunities in its diverse industries.

But the high cost of living, especially in the real estate market, makes it challenging for some. Housing in Los Angeles is extremely expensive, and the city has some of the most competitive real estate markets in the country.

For example, the average listing price on a home in LA is around $815,000. If you’re looking to buy a home in Los Angeles, you may need a bigger budget than most. The average down payment in Los Angeles is $108,000.

4. Honolulu, HI

The median price to buy a home in Honolulu is $801,000. Honolulu is a beautiful city with an active, tropical climate that attracts many tourists each year. But the high cost of living in Honolulu can be challenging for residents.

The median income in Honolulu is lower than the national median, making it difficult for many to afford the high cost of living. For example, the average cost of a gallon of gas in Honolulu is $5.83 compared to $2.80 nationwide. If you’re planning to buy a home in Honolulu, you can expect to pay about 9% in real estate taxes on top of your mortgage.

5. New York City, NY

The median price to buy a home in New York City is $919,000. New York City is one of the most expensive cities in the world, and the cost of housing is a major reason why.

New York City has some of the most expensive real estate markets in the country and strict lending requirements. For example, the average price of a home in Manhattan is $1,895,000. If you’re planning to buy a home in New York City, you should prepare for a large down payment too. The average down payment in New York City is $160,000.

6. Boston, MA

The median price to buy a home in Boston is $699,000. Many people choose to live in Boston for its access to higher education, healthcare, and research institutions like Harvard and MIT. The high cost of living in Boston can be challenging for residents, but especially for those looking to buy a home.

The cost of housing in Boston is high, and the region has some of the strictest lending requirements in the country. If you’re planning to buy a home in Boston, you can expect a large down payment of about $100,000.

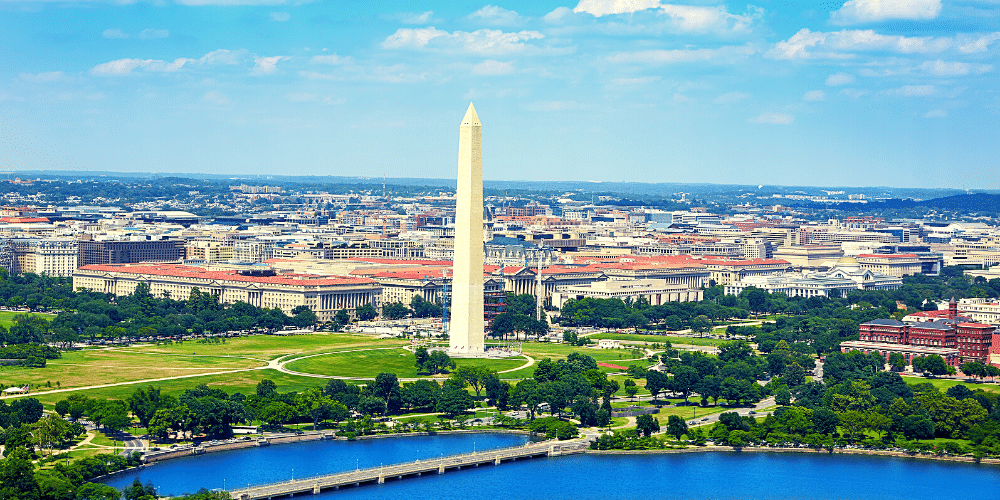

7. Washington, DC

The median price to buy a home in Washington, DC is $772,000. Washington, DC is the capital of the US, and many government employees and contractors call this city home.

The high cost of living in Washington, DC can be challenging for residents, but especially for those looking to buy a home. The cost of housing in Washington, DC is one of the highest in the country. If you’re planning to buy a home in Washington, DC, you can expect a large down payment of about $99,000.

8. Seattle, WA

The median price to buy a home in Seattle is $739,000. Seattle is one of the fastest-growing cities in the US, and the city’s thriving economy is a major reason why.

The high cost of living in Seattle can be challenging for residents, but especially for those looking to buy a home. The cost of housing in Seattle is high, and the city has some of the most competitive real estate markets in the country.

If you’re planning to buy a home in Seattle, you can expect a large down payment of about $99,000.

Comparing Costs to the National Median

In total, we’ve looked at 8 cities and what it will cost you to buy a home in each of them compared to the national median. We’ve seen that the median price to buy a home in a city can be much higher than the national median, making it a challenge to find affordable housing.

Buying a home is a major financial decision, and the price of a home varies widely depending on where you live. It’s important to research the cost of living in any city before deciding to settle down.

The most expensive cities to buy a home tend to be in major metropolitan areas, with prices that often exceed the national average. The cost of living in any city may be a challenge, but with the help of a discount real estate agent, you can reduce your expenses and save money.